Introduction

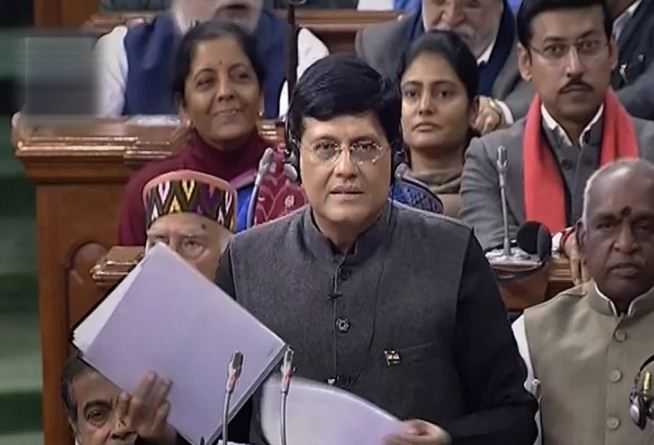

The Union Finance Minister, Piyush Goyal announced the Interim Budget for 2019 on Friday, the 01st of February 2019. New schemes or any policy measures are not generally unveiled in the Interim Budget. However, it is contemplated that along with the interim budget, the government will present the vote on account for the upcoming four or five months. With the General Election scheduled in March or April of 2019, the full-fledged Budget will be announced only after the new Government comes to power.

Note: Union Minister Piyush Goyal is temporarily in charge of the ministry of finance, till the time, the Finance Minister Arun Jaitley return from his indisposition.

At A Glance

India is expected to have an economic boost in the next five years and be a USD 5-trillion economy. As per the forecast, over the next eight years, we can seek to become a USD 10-trillion economy.

- For 2018-2019, fiscal deficit has been at 3.4% of GDP

- In the financial year 2020, the overall expenditure is seen at ₹27.84 trillion.

- In the financial year 2020, the capital expenditure is seen at ₹3,36,292 crore

- In the fiscal year 2020, the schemes of Central Government to get a ₹3,27,679 crore.

- It has recuperated ₹3 lakh crore through the bankruptcy code.

- The existing account deficit for the financial year 2018 and 2019 is seen at 2.5% of GDP.

- The banks like Bank of India (BOI), Bank of Maharashtra and Oriental Bank are not anymore under the RBI’s prompt remedial action.

The Interim Budget covered:

- Taxation policy

- Rural Sector

- Labour

- GST

- Health

- North East

- Defence

- Railways

- Women

- MSME and Traders

- Fiscal Plan

- Entertainment Industry

- And Various Other factors

Taxation policy

- Income tax exemption has been raised to ₹ 5 lacs, and if individuals invest in provident funds and prescribed equities, he can claim exemption up to the gross income of ₹ 6.5 lacs.

- The rate of income tax to continue at the current percentage.

- IT returns to be processed within 2d hours, and it will be paid within the subsequent two years.

- Tax to be exempted on notional rent of two properties.

- Rental income’s TDS limit is increased to ₹ 2.4 lakh.

- The benefit of rollover of capital gains is extended to two residences and up to 2 crores, which can be claimed once in a lifetime.

- Rural Sector

- An announcement of Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), under which the Government will transfer ₹ 6000 directly to every farmer (with less than 2 hectares of land) each year, in three in three portions.

- Rashtriya Gokul mission budget is increased to ₹ 750 crores.

- For maintenance and genetic development of cows, Rashtriya Kamdhenu Ayog to be set up.

- New distinct Department of Fisheries to cater to 1.5 crore fishers.

- For Animal husbandry and Fisheries: 2% interest grant. An added 3% if repayment is made timely.

- Rebate of 2% on interest to farmers affected during a disaster will now be given for the entire period of loan payment.

- For all 22 crops, an increase of MSP (minimum support price) will be 1.5 times the cost of production.

- ₹60,000 crore allocated under the Mahatma Gandhi National Rural Employment Guarantee Act 2005.

- Over the future five years, the Government has plans to convert 1 lakh Indian villages into Digital Villages.

Labour

- Workers in the unorganized sector will be eligible for a confirmed pension of ₹3000 per month under the Pradhan Mantri Shram Yogi Mandhan scheme after the individual attains the age of 60 years. For this, the worker will need to contribute an amount of only ₹ 100 or 55 every month till 60 years of age.

- With effect from 01st April 2019, the New Pension Scheme (NPS) had been improved from 10% to 14%.

- Gratuity limit payment raised to ₹ 20 lacs from ₹ 10 lacs.

- ESI will now cover up to ₹ 21,000.

- There is an increase in the minimum pension also (up to ₹ 1000).

GST

- GST is expected to be reduced for house buyers.

- Interest rebate of 2% for small and medium size business registered under GST, on a loan amount of ₹ 1crore.

Healthcare

- Haryana to have its 22nd AIIMS.

- Estimate of the National Health Mission budget increased from ₹ 30,634 crore to ₹ 32,251 crores.

North Eastern States

- Allocation of funds to be hiked by 21% to ₹ 58,166 crores in 2019-2020 Budget Estimates.

- A recent addition to the air map: Arunachal Pradesh.

- A recent addition to the rail map of India: Meghalaya, Tripura, and Mizoram.

- Due to the improvised navigation capability of the river, the Brahmaputra, chances of container cargo movement introduced.

Defence

- For the first time in India’s history, Government to hike the defence budget to over ₹ 3 lakh crore’ with provision for additional funds, if required.

- Under One Rank, One Pension scheme, ₹ 35 thousand crores have been disbursed over the last few years.

Railways

- Proposed capital support of ₹ 64,587 crores in 2019-2020 Budget Estimates.

- Total capital expenditure proposed to be ₹ 1,58,658 crores

- The expected improvement in an operating ratio from 98.4% in 2017-18 to 96.2% in 2019 fiscal year and 95.2 in the 2020 fiscal year.

- Expected to be the safest years for railways.

- To eliminate all Unmanned Level Crossings on a broad gauge network.

- A first of its kind developed and manufactured by India, a semi-high-speed express train, “Vande Bharat Express” to be introduced.

Women

- With the Mission to Protect and Empower Women, fund of ₹ 1330 Crore is allocated.

- Maternity leave will continue to be six months along with the benefit of cash compensation under the Pradhan Mantri Matru Vandana Yojana for pregnant working women.

- Under the Pradhan Mantri MUDRA Yojana, more than 70% of the recipients are women.

- Under the Ujjawala Yojana scheme, ₹ 6 crores free LPG connections are planned.

MSME and Traders

- If a small and medium enterprise, registers for GST, it will get 2% subvention on interest on an incremental loan of up to ₹ 1 crore.

- As per the plan, at least 3% of the total 25% sourcing for the Government undertakings will be from women owned SMEs

- Internal trade; DIPP which has been renamed as Department for Promotion of Industries and Internal trade will be under high priority of the Government’s plan.

Fiscal Plan

- The fiscal deficit is nailed at 3.4% of GDP for 2019-20

- The target of 3% of the fiscal deficit is aimed to be achieved by the financial year 2020-21.

- The fiscal deficit has been cut down to 3.4% in 2018-19 with respect to approximately 6% which has been there seven years ago.

- There has been an increase in the total expenditure of over 13% amounting to ₹ 27,84,200 crore in 2019-2020.

- The total capital expenditure for 2019-20 is projected to be around ₹ 3,36,292 crores.

- Allocation of a fund to CSS or the Centrally Sponsored Schemes have been increased to ₹ 3,27,679 crores in the year 2019-20.

- Indian Government is assertive on achieving the disinvestment target set at ₹ 80,000 crores.

- Heavy focus is now being given on consolidating debt along with the consolidation of fiscal deficit.

Entertainment Industry

- Lives of Indian filmmakers to become smoother with access to the Single window clearance. They will also have the comfort of shooting films.

- Regulatory provisions will depend mostly on self-declaration.

- To bring strict vigilance of piracy and to control it, plans to announce anti-cam cording provisions in the Cinematograph Act.

Others

- To support the National Program on Artificial Intelligence a new portal named, New National Artificial Intelligence to be introduced.

- For identification of all the outstanding De-notified nomadic and semi-nomadic tribes, a new committee under NITI Ayog is to be formed.

Chief Areas of Fund Allocations

- Rural Development: in comparison to the current fund allocation of ₹ 1.12-lakh crore, funds have been augmented by 4.6 percent to ₹ 1.18 lacs crore for the upcoming financial year.

- Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA): ₹ 60, 000 allocated crore for MGNREGA scheme in 2019-20 Budget Estimates. The MGNREGA, i.e. Mahatma Gandhi National Rural Employment Guarantee Act has been introduced in 2005. It aims at providing manual and unskilled work to each individual above 18 years residing in the rural areas of India, for at least 100 days in a year.

- In the fiscal year 2018-19, allocation of funds to NREGS was ₹ 55,000 crore.

- Pradhan Mantri Awas Yojana (PMAY-G): the distribution of the fund is reduced to ₹ 19,000 crores from ₹ 21,000 crores in 2018-19.

- Pradhan Mantri Gram Sadak Yojana (PMGSY): it is the same as it was in the last financial year and it stands at ₹ 19,000 crores in the fiscal year 2019.

- Education sector: funds of ₹ 93,847.64 crores to be allotted in the education sector for 2019-20, which is an increase of over 10 percent from ₹ 85,010 crores 2018-19

- The budget estimation for higher education is at ₹ 37,461.01 crores, and ₹ 56,386.63 crores have been held in reserve for school education.

- Job and Skill Development: Funds have been increased to ₹ 7,511 crores in 2019-20 as compared to ₹ 5,071 crores in 2018-2019.

- Urban Rejuvenation Mission under Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and Smart Cities Mission: Budget estimation is increased to ₹ 13,900 crores in 2019-20to from ₹ 2,169 for the 2018-19 fiscal year.

- Food Corporation of India: Subsidy for food to Food Corporation of India (FCI) under National Food Security Act is hiked to ₹ 1, 51, 000 crore in the financial year 2019-20 from ₹ 1, 38, 123 crore of last fiscal year.

- Space Technology: budget allocation has been raised to ₹ 7,483 crores from ₹ 6,576 crores.

- National Highways Authority of India: hiked to ₹ 36,691 crores from ₹ 29,663 crores in the upcoming financial year.

- Transfer of Direct Benefits: it is increased to ₹ 29,500 crores from ₹ 16, 47800 crores.

- Subsidiary for Urea: it is expanded to ₹ 50, 164 crores from ₹ 45,000 crores.

- The budget for Sports: it is raised to ₹ 2216.92 crores in 2019-20 from the amount of ₹ 2002.72 (2018-2019) crore.

- Allocation for Integrated Child Development Scheme (ICDS): it is amplified by over 18% to ₹ 27,584 crores in the budget estimation of 2019-20.

- Considerable raise in fund allocation for the Scheduled Castes (SC) and Scheduled Tribes (ST)

- Apportionment of the budget for the SCs is increased by 35.6% to ₹ 76,801 crores in budget estimation for 2019-20 from ₹ 56,619 crores in budget estimation 2018-19.

- Apportionment of a budget for the STs increased by 28% to ₹ 50,086 crores in 2019-20 budget estimation from 39,135 crores in budget estimation 2018-19

The vision for the year 2030 in Budget

Besides presenting the Interim Budget, the Finance Minister has also laid out the Government’s ten point vision for India to be attained by 2030.

They are as follows:

- Next Generation Infrastructure also is known as Gen-X Infrastructure is to make available an “ease of living” for all citizens.

- Vision Digital India is to make sure digitalization reaches to every corner of the country and enhances the life of each citizen.

- Cleaner and Greener India is to make India a pollution free country by leading the transport revolution in the form of electronic transports and to focus on renewables.

- Industrializing Rural India is to increase the usage of contemporary digital technologies which will create enormous employment opportunities.

- Clean Rivers is to make safe drinking water available to every Indian citizen, by introducing the usage of micro-irrigation methods.

- Oceans and Coastlines are mounting up of Sagarmala.

- Space Programme – An Indian astronaut is to be placed in space by 2022, and thus making India a launch pad for the entire world.

- Self-Sufficient India is to ensure that India becomes self-sufficient in its food production and to improve agricultural yield with significant prominence on organic food production.

- Healthy Country to make sure a stress less, affordable, and all-inclusive wellness arrangement for every citizen.

Minimum Government, Maximum Governance is to put in place a pre-emptive, responsible, approachable administration and automated governance system.