The Food Processing Industry is experiencing unparalleled growth fuelled by the growing food demands of Indian population and exciting opportunities in the retail sector.

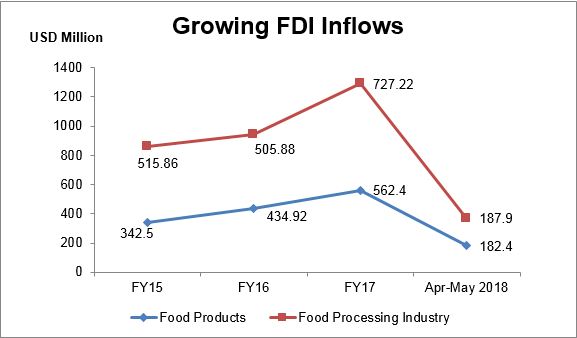

Backed by favourable government policies and fiscal incentives; the industry has beckoned keen interest among global investors. The Food Processing Industry recorded foreign direct investment inflows of USD 727 million in FY17 up 43% from the previous fiscal.

Recent Investments:

May 2018 - Future Group plans to infuse USD 51.8 million to open 140 exclusive FBB outlets aiming to double turnover in two years.

February 2018 – Amazon-the first foreign e-commerce company to have entered the food retail market in India stocks and sell food items directly to consumers.

February 2018 – The Food Processing Park at Vinchur in Nashik attracts an investment of USD 150 million, expecting to generate 5,400 jobs. During the ‘Magnetic Maharashtra’, global investors’ summit 15 food processing units signed MoUs with the state government.

January 2018 - Lulu Group – a UAE based company signed a MoU to invest USD 400 million in the retail and food processing industry in Telangana.

November 2017 - ITC is investing over USD 1.55 billion in food processing and logistics facilities, PepsiCo, along with its partners, looking to invest USD 2 billion in the next 5 years. Hershey Co is planning to invest USD 50 million in the next 5 years.

Industry Figures at a Glance

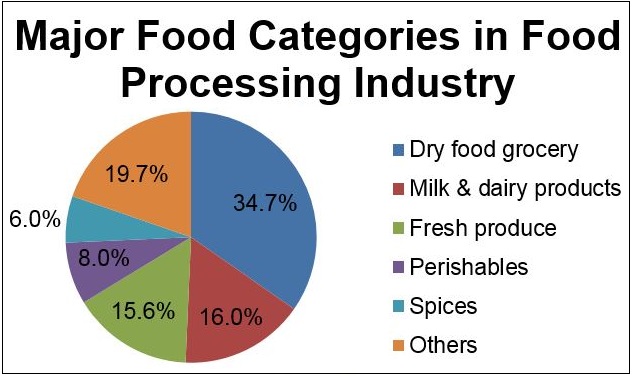

The size of the processed food market in 2016 was USD 322 billion. This figure is expected to touch USD 543 billion by 2020 growing at a CAGR of 14.6%.

By 2020, the food processing industry is likely to attract investments of the order of USD 33 billion. Food Retail business will soar to USD 482 billion. Dairy segment is expected to contribute by doubling to USD 140 billion. Indian household consumption is likely to treble making India the 5th largest consumer by 2030.

By 2020, the food processing industry is likely to attract investments of the order of USD 33 billion. Food Retail business will soar to USD 482 billion. Dairy segment is expected to contribute by doubling to USD 140 billion. Indian household consumption is likely to treble making India the 5th largest consumer by 2030.

What’s driving this growth?

- 3 billion Consumer base with a strong preference for branded food

- India is the largest producer of several agri products

- Favourable regulatory environment and policies

- Robust supply chain and logistics infrastructure

Infrastructure Investments: India has a robust infrastructure with 12 Mega Food Parks and another 42 planned with a total project cost of USD 2.3 billion. The Food Parks aim to link agri-produce to the market to maximize value to the farmers by minimizing wastage and generating employment. Mega Food Parks consist of collection center, primary processing centers, central processing centers, cold chains and plots for setting up food processing units.

FDI Regulation: 100% FDI is permitted under the automatic route in food processing industries. 100% FDI is allowed through government approval route for trading, including through e-commerce in respect of food products manufactured or produced in India.

Favourable Government Policies:

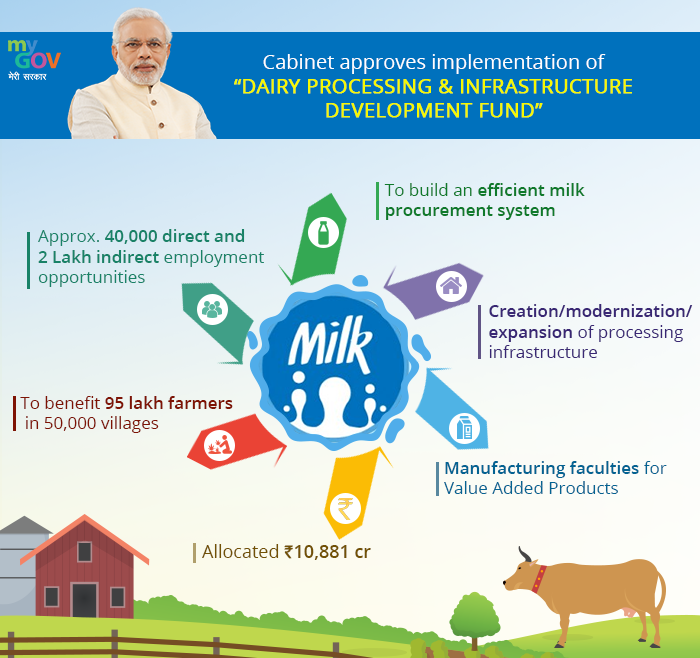

- Dairy Processing & Infrastructure Development Fund (DIDF) plans to spend Rs 10,881 crore during the period from 2017-18 to 2028-29 to build an efficient milk procurement system by setting up of chilling infrastructure & installation of electronic milk adulteration testing equipment, creation/modernization/expansion of processing infrastructure and manufacturing faculties for Value Added Products for the Milk Unions/ Milk Producer Companies.

- Pradhan Mantri Kisan Sampada Yojna (PMKSY) — Allocation has been increased from USD 110 million in RE 2017-18 to USD 215.2 million in RE 2018-19.

- Tomato, Onion and Potato processing- Operation Green has been launched to promote FPOs, agro logistics, processing facilities and professional management with a sum of USD 76.9 million.

- State of the Art Testing facility would be set up at 42 Mega Food Park to promote Agri export from current USD 30 billion to USD 100 billion.

- Corporate Income Tax has been reduced from 30% - 25% to companies having annual turnover up to USD 38.5 million for all sectors.